Church organisations have to keep a tight rein on their cashflow, and should better exploit their assets, If only to be good stewards of what they have graciously received in faith. No longer in a position (for lack of paid work) to continue giving the sort of cash required by St Michael’s, I could give my time, and offered to help put the presbytery on the short-term rental market.

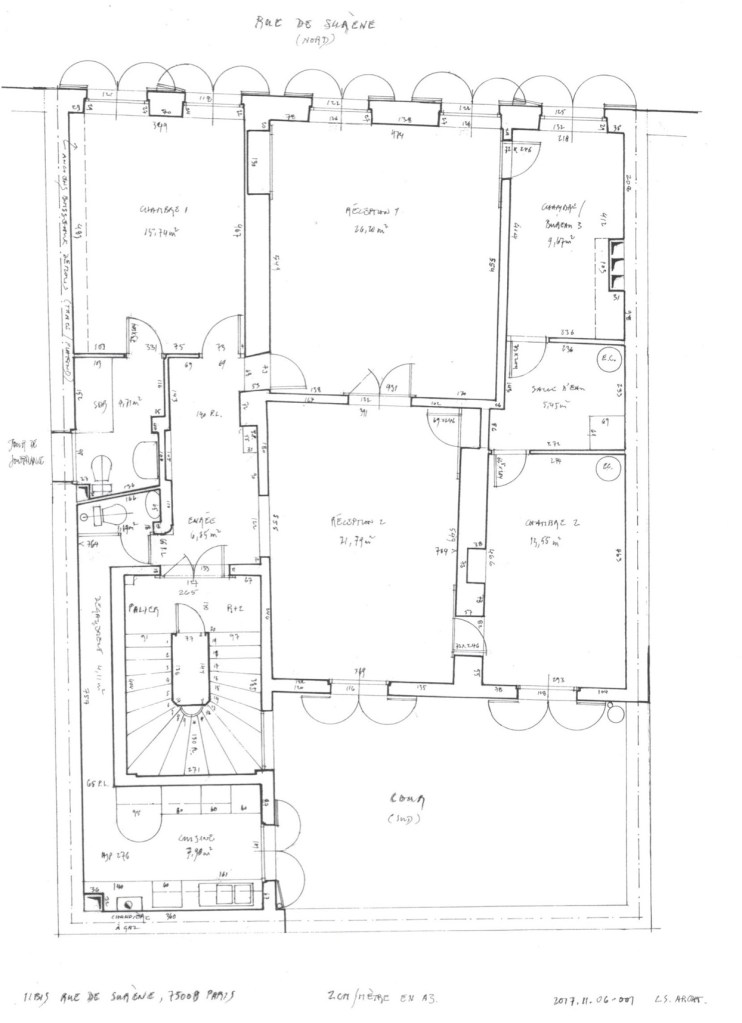

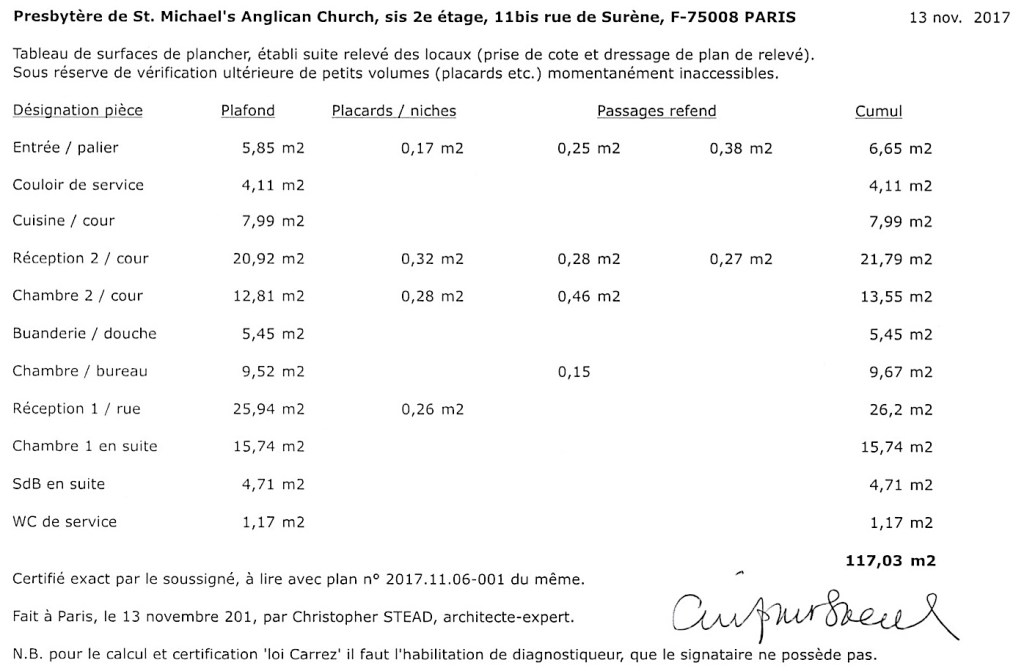

Hence this survey, undertaken to encourage the church to offset monthly outgoings with rental income on momentarily vacant assets, during the so-called ‘inter-regnum’ between pastoral appointments, conceivably far superior to any increase in individuals’ combined giving during the same period.

Church wardens understood the logic, one having been trained as an architect, the other working independently in real estate. I got the go-ahead.

The initiative fell however foul of new French legislation, not quite yet applicable. Under that, short-term rental of accommodation other than domicile principal being deemed a commercial activity (requiring change-of-use planning consent) any failure to seek prior municipal authorization would incur a disproportionate sanction (a fine of 50.000 Euros per square metre, no less).

Despite the debatable applicability of this ruling to the given intention (a short term let ot what is effectively the incumbent’s principle residence), in-house legal advice was agin taking any risk. So the flat remained un-let for another 6 months, and church finances were little better off.

However, we can thank God that COVID has since set the cat amongst the pigeons of precisely those potentates that lobbied (to save their own privileges) against others’ legitimate management (viz. short-term rentals) of their own assets.

Moral : do not mess with what profits a prophet. You have it coming.

Related or parent pages :

Architectural Surveys & Reports

Interventions By Date (reverse chronology)